I got many queries from world accountants and they asked me, you have explained many advance features of tally 9, but we also want to know, what advantages of Tally are. So, I am telling different advantages of tally 9 and I have written title of this article Hidden Diamonds in tally 9 after reading you will realize what is tally in real sense. I am not salesman or dealer of tally software, but as accounting professional, it is my basic duty to provide full information about accounting and accounting software.

I got many queries from world accountants and they asked me, you have explained many advance features of tally 9, but we also want to know, what advantages of Tally are. So, I am telling different advantages of tally 9 and I have written title of this article Hidden Diamonds in tally 9 after reading you will realize what is tally in real sense. I am not salesman or dealer of tally software, but as accounting professional, it is my basic duty to provide full information about accounting and accounting software.Understand the rule of Thumb: -

It is general rule that we know the advantages or benefit, we just apply the ratio rule

Return on Investment (ROI). So, if we try to apply this rule on tally 9, we can change with following way.

Return on Tally 9 purchasing

Profit from tally software in the form of benefits / Advantages and facilities

= --------------------------------------------------------------------------------------------

Total cost on Purchase of Tally Software

In above ratio, if the total profit is more than total cost of purchase of Tally software, then we can say that Tally is real diamond in heart of accountants.

I am telling different benefits which we

IST benefit

Tally has saved all paper works, it means the cost of all paper work = Zero = It means before tally, we had to all work on papers and sometime paper work cost was more than the benefit of information in small business type organization . But after tally using , most benefit is gotten by small scale business organizations .

2nd benefit

In one tally software, you can keep records of unlimited companies. In manual accounting, it is not possible that a single accountant can keep the record of 20 companies. But, in my contacts, there are many professional accountants of Mumbai and Delhi who are tracking all records of more than 20 companies in tally. Billions Rupees transactions of more than 20 companies and just one tally software. Take idea what is the efficiency and what are the benefits of tally software.

3rd benefit

After coming tally 9, it has made simple system of recording and calculation of all tax responsibility. Different tax responsibilities like VAT, FBT, Service tax, Excise ModVAT, Custom duty, TDS, Advance tax, etc. can easily calculate and record in tally 9. Now, companies are demanding tally 9 professional in first eligibility because they are keeping all records in tally and without knowledge of tally , A MBA is also fail to enter in Company as Account Manager .

4th benefit

Tally provides some exceptional reports which are not possible to make in manual accounting. In these exceptional reports, you can find negative stock, negative ledger, overdue receivables, overdue payables, Memorandum vouchers. These reports are very useful, if you know its benefit. These reports are also used to find out frauds and check by spot internal auditors.

5th benefit

Many accountants did not know that tally can be easy use to track accounting of foreign business. Because in tally’s configuration makes suitable tally for providing the information export shipping details, nos. of containers and kinds of packages use in export option. These informations are very useful for exporters . For activate these options, you have to click configuration, then click invoices, delivery notes and orders . Here you can yes different exporter’s options.

Many accountants did not know that tally can be easy use to track accounting of foreign business. Because in tally’s configuration makes suitable tally for providing the information export shipping details, nos. of containers and kinds of packages use in export option. These informations are very useful for exporters . For activate these options, you have to click configuration, then click invoices, delivery notes and orders . Here you can yes different exporter’s options.6th benefit

There are few accountants who know that when we make the voucher entries of payroll, at that time we also create cost allocation by only writing yes in voucher entry configuration in the front of (Allow cost center allocation in payroll vouchers.)

There are few accountants who know that when we make the voucher entries of payroll, at that time we also create cost allocation by only writing yes in voucher entry configuration in the front of (Allow cost center allocation in payroll vouchers.)7th benefit

One of the best advantages of tally that in tally we can see any report by filtering rang option. If you know to use excel, you can better understand what is filtering and what is rang. But, here I am telling you that it is just option. Suppose if you see cash flow statement greater than Rs. 100000 on all items then you can check cash inflow and cash outflow more than Rs. 100000 each items.

8th benefit

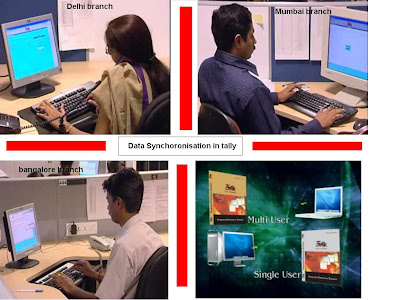

Wth tally accounting software we can synchnroise data over multiple locations. Data synchnroise is simple, cost effective and just few minutes we can apply it . With synchnorising option of tally, we can easy share or collaborates all accounting information more than one branch of company.

9th benefit

With the help of tally 9, accountants can generate all type of VAT through e-return files .

10th benefit

Tally can be operated in 13 language, if you are businessman and prefer to use tally in your local language , tally is providing support to record your transactions in your own language .You can also print and view reports another languages also .

Above 10 benefit are just one diamond , tally is ocean of diamonds and you can calculate Return on investment in real time .

Life time benefits = Speed + Advance + Safe + Universal Accounting software